A very binary equity market

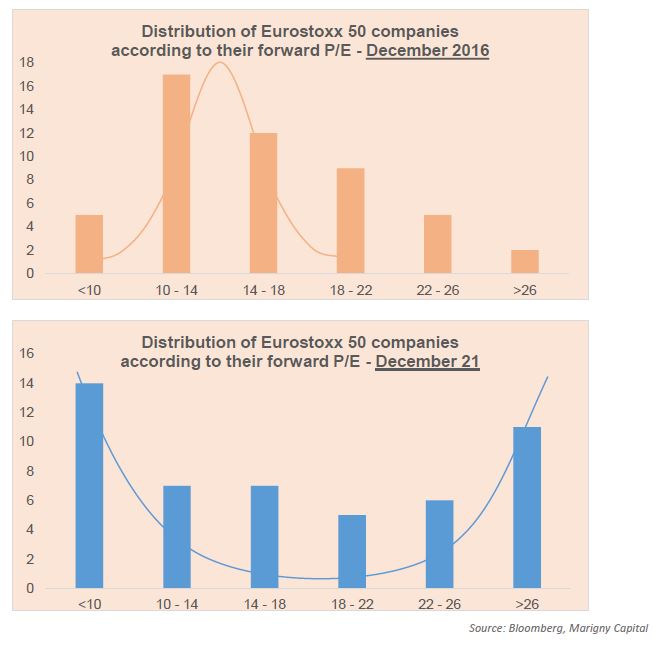

We live in a world of thumbs-up and thumbs-down that leaves little room for nuance as many observers say. Everyone will have their own opinion on the evolution of the world and society, but the fact is that the stock market also seems to be affected by “binarity”. Historically, the notion of average valuation regarding the securities making up equity indices has made sense. Most

stocks traded at valuation multiples close to that of the index, and there were a few exceptions on either side of the distribution with a small number of stocks showing higher multiples and another small number showing lower multiples.

In 5 years, in the Eurostoxx50 universe, the average forward P/E has fallen from 14.1 to 13.1 while the P/E of the index has increased from 13.9 to 14.9. We show below the P/E distribution of the 50 companies of the index and the message is very strong. The polarization is extreme. Unlike the situation in December 2016, investors are very discriminating: when they like a company they pay dearly for it and, conversely, they refuse to pay when they don’t like it. This extreme polarization of equity valuations is one of the characteristics of the equity markets at the end of 2021.

Categories

Last articles

Consumers’ payment habits in Europe

The ECB conducted a study on payment habits in Europe in 2019: Study on the Payment Attitudes of Consumers (SPACE); https://www.banque-france.fr/sites/default/files/media/2021/11/25/space_2020-12.pdf. Although the covid crisis has certainly changed these habits, the analysis remains relevant to compare the differences in practices within Europe..

Robinhood – a textbook case of financial analysis

Robinhood was created in 2013 in the San Francisco area, a few miles from Stanford University. It was at this prestigious university that Vlad Tenev and Baiju Bhatt met. Their ambition was strong: to democratize the financial markets by offering easy access to all apprentice traders. Their slogan was quickly found: “Investing for Everyone”. They […]